past due excise tax ma

The tax collector must have received the payment. The excise rate as set by statute is 25 per thousand dollars of valuation.

Excise Tax Bill Update Town Of Grafton Ma

The average single-family property tax bill in Massachusetts in 2022 is 6719 up 347 from the previous year according to a recent report conducted by the Division of Local Services.

. Corporate excise can apply to both domestic and foreign corporations. Motor Vehicle Excise Tax bills are due in 30 days. If you dont make your payment.

Massachusetts imposes a corporate excise tax on certain businesses. If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 3000 dollars. We accept payment for excise tax warrants at City Hall OR or you may pay at Kelley and Ryans offices located in Leominster RMV Lowell Beverly Lawrence Brockton Taunton.

There are no zero extensions a. Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at Town Hall.

Payment at this point must be made through our Deputy Collector Kelley. Not just mailed postmarked on or before the due date. If you have not received an Excise Tax.

A motor vehicle excise is due 30 days from the day its issued. In addition interest will accrue on the. They are issued at various times of the year when information is received from the RMV.

General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the. If you are unable to find your. How to file an excise tax abatement Need to Know.

Once you enter your NAME please CLICK one of the options below to continue. To START please provide the LAST NAME or COMPANY NAME as it appears on the BILL you received. If a return does not have a tax due and is not filed by the due date this return will be granted an automatic extension until October 17 2022.

Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax. Pay your outstanding obligations online by clicking on the Green area on the home page.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. For excise tax bills that have gone to Warrant you will need to contact and pay to our Deputy Tax Collector. Learn if your corporation has.

If the bill goes unpaid interest accrues at 12 per annum. The tax is due on the 15th day of the third for S. Nonpayment of a bill triggers a demand bill to be produced and a.

Bill Search Please select a search method using one of the following options. 508 894-1203 For motor vehicle abatement forms contact the Assessors Office at 508 894-1212 To change an address or. License Bill Type Parking Find your bill using your license number and date of birth.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. For the total due on a past due excise tax call. Jones Associates 98 Cottage Street P O Box 808 Easthampton MA.

The value of a motor vehicle is determined by the Commissioner of Revenue based on the manufacturers list. Town Hall 116 Main Street Room 109 South Hadley MA 01075 Phone. Motor Vehicle Excise tax bills are due 30 days from the date of issue.

This information will lead you to The State Attorney Generals Website concerning the Tax.

Excise Tax Information Templeton Ma Official Government Website

City Of Hartford Tax Bills Search Pay

Motor Vehicle Excise Tax Bills Gardner Ma

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors

City Of Methuen On Twitter Excise Tax Excise Tax Payments Are Overdue A Fee Will Be Added To Your Account If Not Paid By April 28 2022 Pay Online At Https T Co On1eln8bfw Or

![]()

Federal Excise Tax Receipts Way Down In April

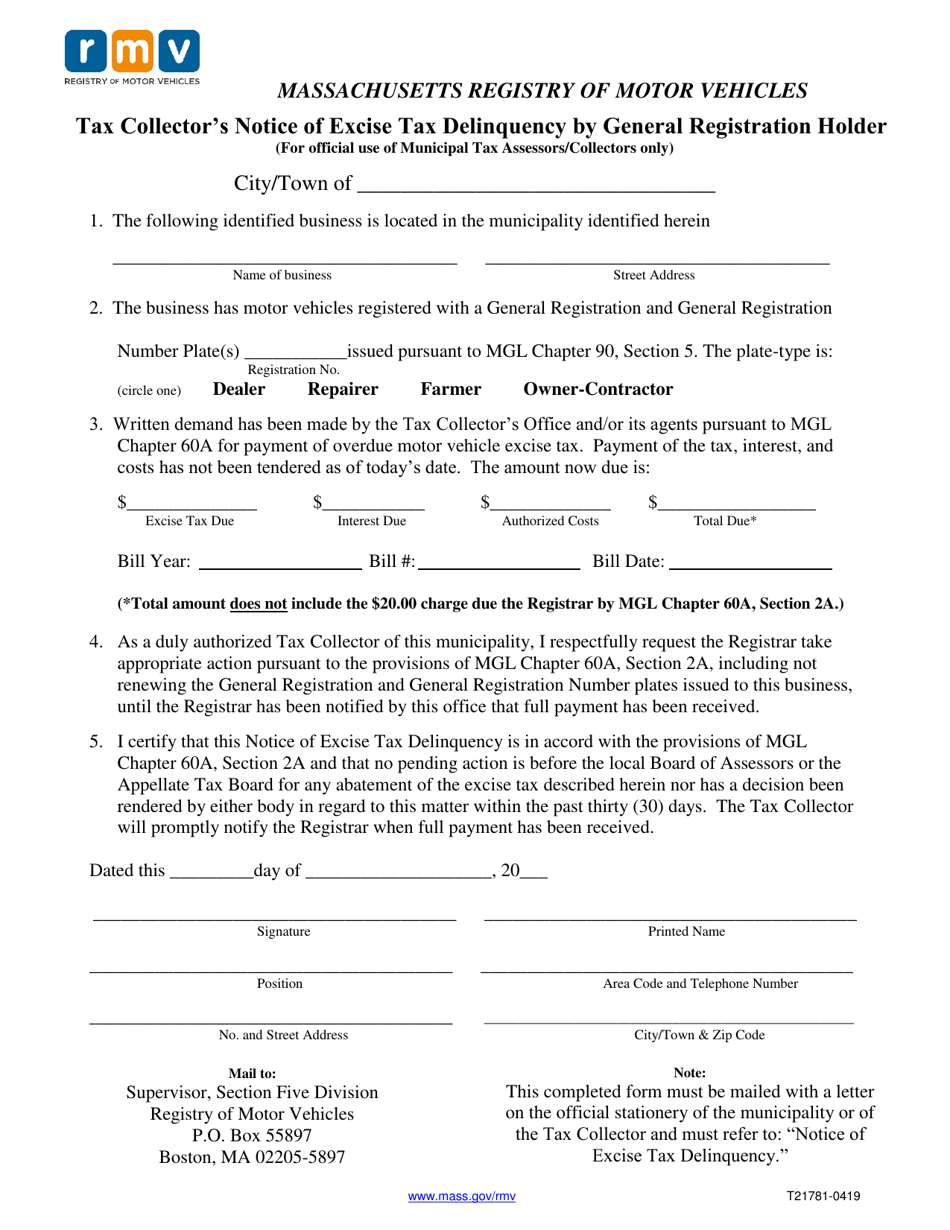

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

Treasurer Collector Town Of Montague Ma

Reminder Excise Taxes Due On March 8 Fairhavenma

Motor Vehicle Excise Tax Bills Gardner Ma

James Bulger Excise Tax Bills From City Of Boston

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

Look Up Pay Bills Town Of Arlington

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills